The Single Strategy To Use For Insurance

Wiki Article

The Main Principles Of Insurance

Table of ContentsOur Insurance IdeasThe Buzz on InsuranceInsurance Fundamentals ExplainedThe Ultimate Guide To InsuranceSome Ideas on Insurance You Should KnowInsurance for Beginners

If you're taking a trip to the United States you will certainly require extra medical cover just how old you are. Traveling insurance policy can cost more if you're over 65.You may be able to maintain expenses down. If you're a UK local and have a European Wellness Insurance Coverage Card (EHIC), you can still use it to obtain health care in EU countries till it ends.

You should still obtain travel insurance coverage before your journey - also if you have an EHIC or GHIC. If it does, you might pick a larger on your traveling insurance plan.

The 8-Second Trick For Insurance

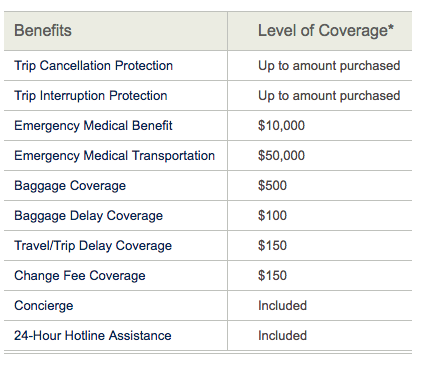

The most affordable plan might not offer finest worth for cash, so it is necessary to inspect what the plan consists of as well as exactly how much it costs. You can inspect what various plans supply as well as exactly how much they set you back by utilizing an online comparison web site. Nonetheless, comparison sites normally just supply basic cover - insurance.Along with these benefits, Allianz Global Help supplies 24/7 aid with emergency situation medical facility care plans, emptyings for medical emergencies, replacing lost or stolen documents, and more.

The 20-Second Trick For Insurance

Furthermore, travel policies with medical protection may cover any illnesses or hospital stays that take place during a trip, yet you need to examine your policy to see if your plan is one of them. Ask on your own: What are the chances you'll be influenced by serious climate or an additional event? Exactly how prepared are you to take risks? Just how much are you going to pay for a back-up plan? Do you have questionable wellness or is a liked one ill? If you can not pay for to cancel and also rebook your journey or your medical insurance doesn't cover you abroad, you need to take into consideration travel insurance.

Insurance - Questions

Travel insurance policy does not cover anything pertaining to a pre-existing condition yet limitations for pre-existing problems that do not relate to emergency situation medical evacuation or repatriation. If you have a pre-existing medical condition, it is necessary to get the protection you need to be risk-free on your trip. There are plans offered for pre-existing conditions so speak with your insurance coverage supplier to locate the most effective prepare for you.If you're intending to take a trip, there are lots of factors why travel insurance may be right for learn the facts here now you: You'll recognize you're shielded in instance of a crash or unexpected health problem. The expense of treatment can be a lot greater abroad than in Canada, They'll ensure that you have access to treatment and also schedule you to find home if required.

Traveling insurance coverage is a type of insurance that covers the prices as well as losses connected with traveling. It works defense for those traveling domestically or abroad. According to a 2021 study by insurance policy business Battleface, almost fifty percent of Americans have encountered fees or had to soak up the expense of losses when traveling without traveling insurance.

The Of Insurance

Trip cancellation or journey interruption insurance coverage over here may be squashed if you're taking a trip to an area that's recognize to have been impacted by a significant weather condition occasion such as a cyclone or quake. Luggage and individual impacts insurance coverage shields lost, taken, or damaged possessions during a journey. insurance. It may consist of insurance coverage throughout travel to as well as from a destination.Clinical protection can assist with medical expenses, assistance to situate doctors and medical care centers, as well as also assist in acquiring foreign-language services. Just like other plans, protection will certainly vary by rate and also supplier. Some might cover airlift traveling to a clinical center, prolonged keeps in international health centers, and medical emptying to obtain treatment.

federal government urges Americans to consult their clinical insurance providers before taking a trip to establish whether a plan expands its insurance Recommended Site coverage outside the nation, as the federal government does not insure people or pay for clinical costs sustained abroad. For instance, medical insurance might cover the guaranteed in the U.S. and Canada, however not in Europe.

The Only Guide for Insurance

If you have Medicare or Medicaid, realize that they generally do not cover clinical expenses overseas. Prior to acquiring a policy, it is important to review the plan arrangements to see what exemptions, such as preexisting clinical problems, apply and also not think that the new insurance coverage mirrors that of an existing plan.Report this wiki page